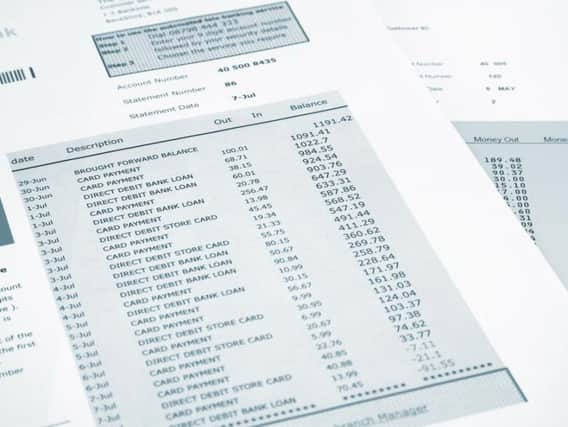

Banking on clearer overdrafts

Yet the Competition and Markets Authority says banks should do more to help customers be aware of the risks of overdrafts. It wants them to cap fees on unarranged overdrafts and do more to warn customers before they hit the red.

The CMA’s conclusion following an 18-month investigation is that banks could save their customer more than £1bn between now and 2021.

Advertisement

Hide AdAdvertisement

Hide AdThe CMA also suggested that competition between banks in the retail sector is weak. This leads to a risk of companies taking their

customers for granted. In fact, the report noted that 60 per cent of customers stayed with the same bank for more than a decade.

So what is the CMA suggesting?

Better automatic alerting when a customer is about to go overdrawn, for example by text or push notification.

Banks should do more to make sure customers are getting good value – if interest rates change, for example, the onus should be on banks to let their customers know

Advertisement

Hide AdAdvertisement

Hide AdMore switchability and connectivity, using more, better technology such as apps with in-built comparisons

Loan costs need to be more transparent, especially for businesses

The question is whether the CMA has been strong enough. For example, some banks already cap overdraft fees – Halifax tops out at £100 per month, while the maximum for a Barclays overdraft is £35

When Moneyfacts counted up the average charges for an unauthorised overdraft, it came out a £57.50 per month. At that average fee, that could add up to £690.

Advertisement

Hide AdAdvertisement

Hide AdSince 2014, according to the CMA, retail banks in the UK have made a whopping £1.2bn on charges.

Alasdair Smith, chair of the CMA’s Retail Banking Investigation, said: “The banking market is not working well for customers or for small businesses at the moment, primarily because it’s very hard for customers to work out what their bank really costs them.”

So what do you if you want to complain about an overdraft?

Complaining to the Financial Ombudsman

If you’re thinking about complaining to the Financial Ombudsman Service, you first need to approach the bank, insurer or financial service provider. They need to be given the opportunity to resolve your issue.

You must wait eight weeks before escalating your complaint to the ombudsman, but the ombudsman will contact the business about your complaint and ask them to deal with it on your behalf if you don’t wish to raise the complaint with the company directly.

Advertisement

Hide AdAdvertisement

Hide AdOnce you’ve waited eight weeks, then you can go to the Financial Ombudsman Service

Helpful hints when making a complaint about finance

Get your complaint in writing –this is the easiest way of making sure it gets recorded properly

If you do need to make a phone call, Resolver can record it and store it for you in your online case file.

Record as many details as possible – who you speak to, their job titles, the dates and times of your calls with them.

Advertisement

Hide AdAdvertisement

Hide AdBe polite. You might well be really frustrated, but it’s important to keep calm, especially if you’re complaining to the Financial Ombudsman – effectively a third party that has had nothing to do with your complaint other than an intent to solve it.